There are many working professionals and business owners who want to invest their savings into the stock market as it has the potential to provide higher returns than fixed deposits. Lacking analytical knowledge and due to time limitations, these people struggle to find the best investment opportunities. As a result, they surrender their savings into the hands of mutual funds in the form of SIPs( Systematic Investment Plan) or lump sum investment. Now the question arises how to pick the best mutual fund out of the vast number.

The answer lies in finding out the mutual fund which provides a high rate of XIRR, CAGR and absolute returns. Therefore, in this article we are going to talk about these return ratios in detail so that it could simplify the process of picking the best investment decisions.

What is XIRR?

Extended internal rate of return, or XIRR, is a single rate of return that, when applied to each systematic investment plan, provides the current value of the entire investment (SIP). It is applicable in those conditions where there is multiple cash flow.

SIP, as discussed above, is the best example of multiple transactions. It is the investment in which each instalments have different time periods, due to which calculating the returns of SIPs by using CAGR is not accurate and ineffective. Therefore, XIRR is being used to ascertain the accurate returns of the SIPs.

How is it Calculated?

XIRR or the Extended Internal rate of return formula is a bit complicated, as a result it is calculated through Microsoft Excel. Excel has an inbuilt formula for calculating XIRR.

The formula: XIRR(Value, dates, guess)

Let’s understand calculation of XIRR in Excel through an example

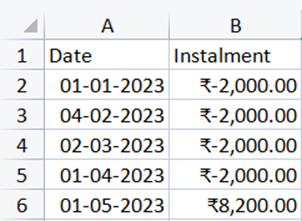

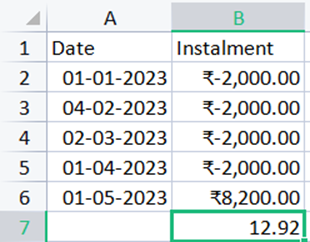

Assume that Mr A, a SIP holder, has planned to enter into an 4 month-SIP. Let’s assume the SIP amount to be- Rs 2000 and the maturity amount after 4 months is Rs 8,200.

Step 1:

Enter the data in excel in such a way that the date should be in one column and the instalments should be in another column corresponding to each respective date with a negative sign as it denotes cash outflow. Along with it right the maturity date and value below date and instalments column.

Step 2:

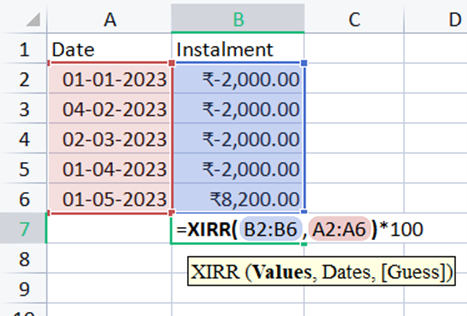

Type below Rs 8200 the formula of calculating XIRR

“= XIRR(B2:B6,A2:A6)*100” and press enter

Step 3:

After pressing enter you will see the value which is the XIRR rate for the given SIP plan.

Mr. A has earned a XIRR of almost 13% on his SIP.

What is CAGR?

The Compounded Annual Growth rate(CAGR) is the tool which is efficient in measuring the rate of return on lump sum investment, unlike XIRR which is used for SIPs. It basically showcases the rate at which one’s investment have grown consistently throughout the maturity period.

Formula: ((Final Value/Initial Value)^1/no. of years) -1

How is it Calculated?

Let’s understand this through the same example of Mr.A, this time Mr. A has made a lump sum mutual fund investment of 50,000 for the period of 5 years. And on maturity he has got RS 55,000. Let’s calculate this using a formula:

CAGR= ((55,000/50,000)^⅕)-1

= 10.36%

Therefore, Mr A’s investment has consistently grown at the CAGR of 10.36%.

Difference Between CAGR and XIRR

| CAGR | XIRR |

| It effectively measures Compounded growth rate year on year basis. | It effectively measures the rate of investments involving multiple transactions in an uneven time period. |

| Lump sum investment | Involves Multiple Cash instalments |

| Absolute return | Annualized return |

What is Absolute return?

Absolute return refers to return obtained from an investment over a fixed period of time. In case of mutual funds, absolute return is regarded as total return from a mutual fund. A mutual fund investor compares the absolute return of various mutual funds in order to find the best one.

How is it Calculated?

The formula to calculate absolute is simpler than XIRR and CAGR. It only requires two values, one being the current value of the investment and the other being the initial value of the investment.

Formula:

Absolute Return = ((Final value – initial value of investment)/ initial value) * 100

Let’s understand this with an example, Mr. B have invested Rs 1,00,000(initial value) in Axis Bluechip fund and at the end of 3 years the invested value has been increased to Rs 1,10,000(Final Value). He want to know the absolute return given by the mutual fund:

Absolute return= (( 1,10,000- 1,00,000)/ 1,00,000) * 100= 10 %

Therefore Mr B has obtained 10% return on his investment.

What is Annualized Return?

Annualized returns is basically the average or geometric mean of return generated every year over a period of time. It states the average per year return obtained by a mutual fund or an investment. By seeing annualized return an investor could easily be manipulated as it doesn’t display the volatility and price fluctuation in the market.

Formula:

Annualized return: ((1+absolute return)^1/n)-1

Difference between Absolute return and Annualized return

| Absolute Return | Annualized Return | |

|---|---|---|

| Meaning | It measures the performance of an investment regardless of the time period | It is the average return on investment per year measured over a period of time. |

| Expressed | It is expressed either in INR or percentage. | It is only expressed in percentage. |

| Calculation | It is easy to calculate as it requires only two values, initial investment value and the final investment value. | It is comparatively difficult to calculate. |

| Comparison | Comparison of absolute return from 2 investments is complicated and challenging. | Comparison of Annualized return of two investments is easy as one can choose the investment providing higher return. |

| Example | Initial value- 100Final value- 150Time Period- 3 yearsAbsolute return= 50% | Initial Value- 100Final Value- 150Time Period- 3 yearsAnnualized return= Absolute return/3 = 14.47% |

Conclusion

These are the tools through which an individual could analyze and find out the best mutual fund or other investments for himself. The first thing which an nascent investor sees is the track record of returns provided by various mutual funds companies. But sometimes, returns are displayed in such a way which could manipulate the customers by showing fake growth. Therefore, every individual should consider the above parameters before investing.

FAQs

How is Absolute return calculated?

Absolute return= ((Final Investment value – initial investment value)/ initial investment value)* 100.